The recent escalation of the Sino-US trade dispute and the US restrictions on suppliers to Huawei will surely affect certain Taiwanese ICT businesses.

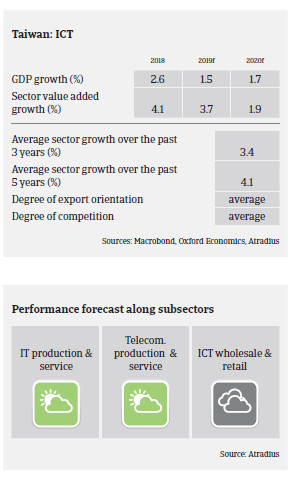

- The demand situation in Taiwan’s ICT industry is expected to remain benign in 2019 with value added growth forecast to increase more than 3.5%. Profit margins of ICT businesses have improved over the past 12 months and are expected to increase further in H2 of 2019.

- Sales are driven by 5G, servers, artifical intelligence and cloud applications. Taiwan strives to become an international pioneer for the commercial use of 5G, which is scheduled to be rolled out in 2020.

- The recent escalation of the Sino-US trade dispute, and especially the US restrictions on suppliers to Huawei will surely affect certain Taiwanese ICT businesses. For the time being, the impact on sales and profitability seems to be limited, while the mid- and long-term consequences are currently hard to predict. Any economic slowdown in mainland China triggered by the trade dispute would surely lead to lower demand for Taiwanese ICT exports to the mainland and other parts of Asia.

- Competition is not overly high in the industry, but more elevated in the wholesalers/channel segment due to price sensitivity. Financing requirements are high but banks are generally willing to lend to the industry.

- On average, payments in the ICT industry take between 30 and 60 days. Payment behaviour over the past two years has been good and the number of protracted payments low. The insolvency level in the ICT sector is average and expected to remain stable in 2019.

- For the time being, our underwriting stance for ICT remains generally open due to stable growth, good payment experience and the fact that the market is dominated by more resilient large corporates. However, we are more cautious with the wholesale and retail segment. It is more exposed to demand and price volatility, and the external indebtedness of businesses is higher than in other subsectors. We continue to closely montitor any impacts of the ongoing Sino-US trade dispute and the Huawei issue.

Související dokumenty

1.13MB PDF